How does P2PE protect your customer’s credit card data and can it actually prevent hackers from stealing your customer’s data?

Why, yes! It can!

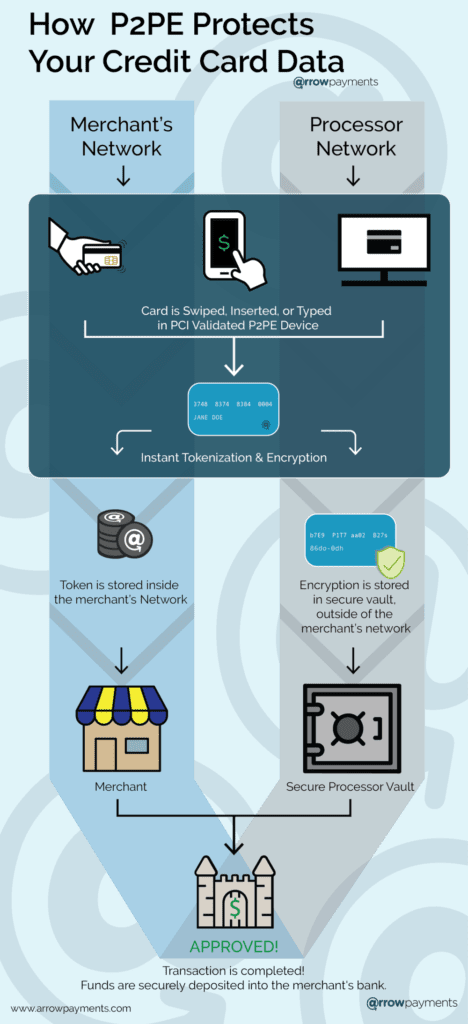

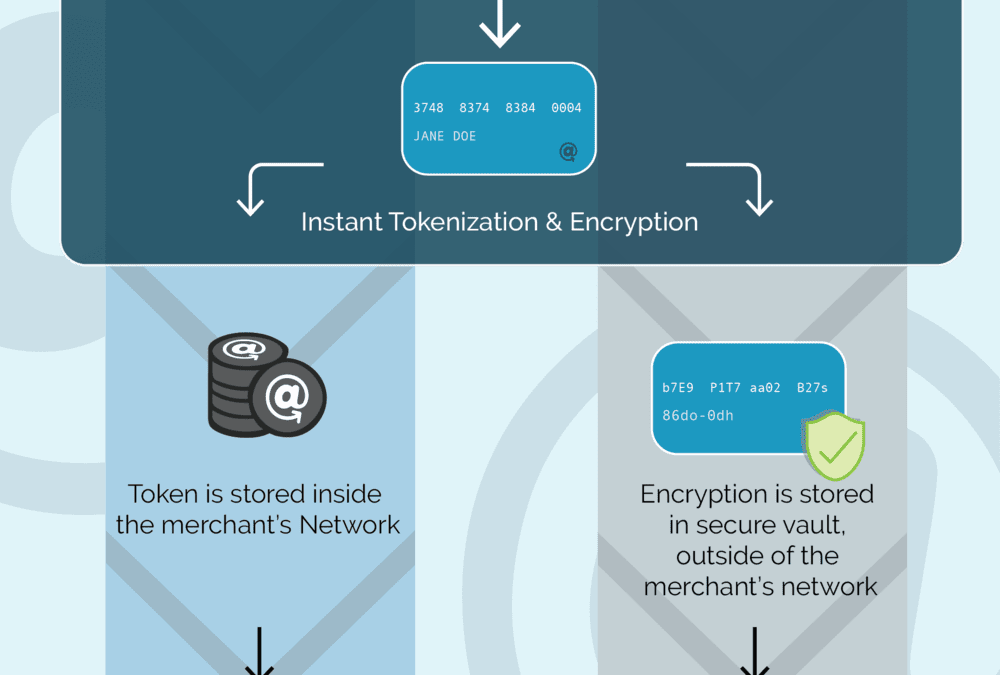

With P2PE, the customer’s credit card data never enters your merchant network. At the moment that the card is swiped, inserted ,or typed, the data is immediately encrypted and stored with the processor’s network. The encrypted data is then turned into a “token” that is stored in the merchants network. The token communicates with the processor’s encrypted data to contact the bank and approve the charge.

If the data on your merchant network became compromised, or if for some reason a hacker got into your merchant system and got ahold of those tokens that were created from the original transaction, the hacker would be S.O.L.

P2PE tokens and encrypted credit card data are useless!

So, rest assured. You’re protected with P2PE & Arrow Payments! #EncryptEverything

Check out our graphic below to learn more about how P2PE can work for you.